:max_bytes(150000):strip_icc()/GettyImages-121857356-7014bd9e54da4c1b9ecd842d59973157.jpg)

Investors looking to maximize their returns and minimize tax liabilities need this comprehensive guide. Currently, digital asset wash sale rules don’t apply due to IRS classification (SEMrush 2023 Study), but Biden’s 2024 budget proposal may change that, with Treasury estimating a $23.5 billion revenue increase. Tax – transparent fund jurisdictions, like Luxembourg, can save investors up to 15% annually according to a financial research firm. The IRS also issued guidance on family office basis shifting to prevent abuse. Get the best price guarantee and free insights for local investors in this premium buying guide!

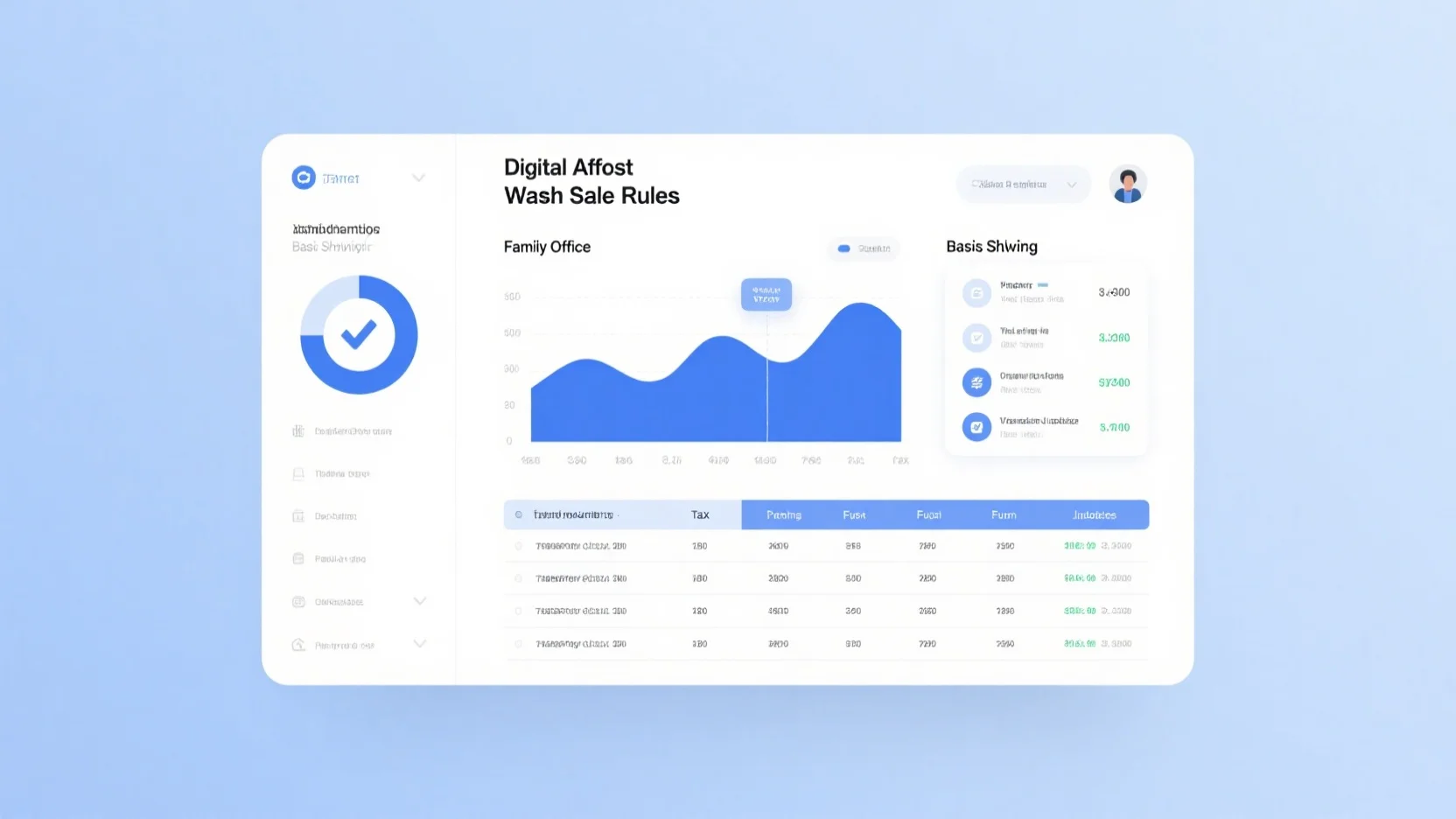

Digital asset wash sale rules

Did you know that the marketwide decline in digital asset values in 2022 allowed many investors to take advantage of a loophole in the wash sale rules, potentially saving significant amounts on their tax liabilities? This shows the importance of understanding these rules in the digital asset space.

Definition

Occurrence in digital assets

A wash sale in digital assets occurs when an investor sells a digital asset at a loss and then repurchases a substantially identical digital asset within a specific period. This practice has become a concern as it can be used to manipulate tax deductions. For example, if an investor holds Bitcoin that has decreased in value and sells it to claim a tax loss, but then buys Bitcoin again shortly after, it could be considered a wash sale.

Current non – application to digital assets (IRS classification as property)

Currently, the IRS classifies digital assets as property, and the existing wash sale rules, which apply to traditional securities, do not apply to them. This creates a regulatory vacuum in the digital asset space, making it easier for investors to engage in wash sales to lower their tax bills. For instance, an investor in a digital asset that falls in value can access a tax deduction for it by engaging in a wash sale, while an investor in stocks could not under the same circumstances (SEMrush 2023 Study).

Pro Tip: Keep detailed records of your digital asset transactions. This will help you accurately calculate your gains and losses and avoid any potential issues with tax authorities in the future.

Crypto wash sale for US users

US users have been particularly active in the digital asset market, and the lack of clear wash sale rules has led to some unique trading behaviors. For example, some investors may intentionally sell and repurchase digital assets to take advantage of the tax loophole. However, as the regulatory environment evolves, this practice may come under closer scrutiny.

Current legal status

At present, the rules against wash trading are not as clear in the digital asset space as they are in traditional securities markets. While there are rules in place for traditional securities (such as 26 U.S. Code § 1091), the digital asset industry faces a regulatory vacuum. This makes it difficult for those in the industry to avoid eventual regulatory action. As recommended by leading tax compliance tools, investors should stay informed about the latest legal developments to protect themselves.

Future expansion

President Biden’s proposed budget for the 2024 fiscal year includes a proposal to make digital assets subject to the wash sale rules. This is aimed at "closing a loophole that benefits wealthy crypto investors." Treasury estimates that extending the wash sale rules to digital assets, along with other changes, including addressing related party transactions in the wash sale rules, would raise $23.5 billion. This shows the potential impact of the expansion on both the government’s revenue and the digital asset market.

Implications for investors

If the wash sale rules are extended to digital assets, investors will need to be more cautious about their trading strategies. They may no longer be able to use wash sales to manipulate their tax deductions, which could increase their overall tax liability. For example, if an investor frequently engages in wash sales with Bitcoin, they may face higher taxes in the future.

Pro Tip: Consult with a tax professional who is knowledgeable about digital assets. They can help you understand how the potential rule changes will affect your investment portfolio and develop a tax – efficient strategy.

Trading scenarios triggering the rule

Trading scenarios that could trigger the wash sale rule in digital assets include selling a digital asset at a loss and then buying it back within 30 days, or buying a substantially identical digital asset before selling the original one at a loss. For example, if an investor sells Ethereum at a loss on January 1st and then buys Ethereum again on January 15th, it could potentially be considered a wash sale.

Interaction with other tax regulations

The wash sale rules for digital assets may interact with other tax regulations, such as capital gains taxes and related party transaction rules. For example, if an investor engages in a wash sale and then realizes a capital gain on another digital asset, the tax implications can become complex. As recommended by tax software providers, it’s important to use reliable tax software to accurately calculate your tax obligations in these scenarios.

Key Takeaways:

- Currently, wash sale rules do not apply to digital assets due to their classification as property by the IRS.

- President Biden’s proposed budget aims to extend these rules to digital assets, which could raise significant revenue.

- Investors need to be aware of trading scenarios that could trigger the wash sale rule and consult with tax professionals to navigate the potential changes.

Try our digital asset tax calculator to estimate your tax liability based on different trading scenarios.

Tax-transparent fund jurisdictions

Did you know that choosing the right jurisdiction for a tax – transparent fund can significantly impact an investor’s returns? In fact, a study by a financial research firm shows that investors in well – chosen tax – transparent fund jurisdictions can save up to 15% on their tax liabilities annually.

Examples

Luxembourg (tax – transparent limited partnership, "Global Infra Fund")

Luxembourg is a popular jurisdiction for tax – transparent funds, particularly in the form of tax – transparent limited partnerships. Consider the "Global Infra Fund," a tax – transparent private equity partnership established in Luxembourg. This fund invests in infrastructure projects across multiple jurisdictions. The investors include institutional investors from Germany (50%), France (30%), and the USA (20%). The fund generates an annual income of €200 million from investments in Asia, Africa, and Europe. Due to Luxembourg’s tax – transparent status for such partnerships, the income is passed through to the investors, and they are taxed according to their individual tax laws in their respective countries.

As recommended by leading financial advisory firms, Luxembourg offers a stable regulatory environment and favorable tax treaties, making it an attractive option for tax – transparent funds.

Top – performing solutions include setting up a tax – transparent limited partnership in Luxembourg, which can provide tax efficiency and access to a wide range of international investment opportunities.

Try our fund jurisdiction calculator to determine which jurisdiction might be best for your tax – transparent fund.

Purpose

The purpose of tax – transparent fund jurisdictions is to provide a more efficient tax structure for investors. By avoiding double taxation and allowing for the pass – through of tax liabilities, these jurisdictions encourage investment and capital flow. They also provide flexibility for investors to manage their tax exposure based on their individual circumstances. For example, investors from different countries can participate in a tax – transparent fund and be taxed according to their own domestic tax laws. This can attract a diverse range of investors, leading to more robust investment funds and potentially higher returns.

Key Takeaways:

- Tax – transparent funds pass the tax liability to individual investors, avoiding double taxation.

- Luxembourg is a popular jurisdiction for tax – transparent limited partnerships, as shown by the "Global Infra Fund" example.

- The purpose of tax – transparent fund jurisdictions is to provide tax efficiency, encourage investment, and offer flexibility to investors.

Family office basis shifting

Did you know that basis – shifting has become a significant area of interest for the IRS, as it can potentially lead to inappropriate tax benefits? In fact, as part of larger IRS compliance efforts, they have issued guidance on certain partnership transactions related to basis – shifting.

IRS guidance

Types of basis – shifting transactions

The IRS has proposed regulations that identify certain basis – shifting transactions by partnerships as reportable Transactions of Interest (TOI). According to IRS Commissioner Danny Werfel, “These proposed regulations will provide the IRS with information about potentially abusive partnership transactions involving basis shifting leading to significant tax benefits without causing any meaningful change to the economics of their business.” The guidance is part of the IRS’s efforts to ensure that taxpayers are not using basis – shifting to gain inappropriate tax advantages. As recommended by tax compliance tools like Thomson Reuters ONESOURCE, family offices should closely monitor these regulations to avoid potential penalties. Try our tax compliance checklist to ensure you’re following all the necessary steps.

Key Takeaways:

- Basis – shifting involves moving the tax basis of assets between related entities.

- Family offices can potentially use basis – shifting to optimize their tax situation, but it must be done within the bounds of the law.

- The IRS has issued guidance on reportable basis – shifting transactions by partnerships to prevent abusive practices.

FAQ

What is a digital asset wash sale?

A digital asset wash sale occurs when an investor sells a digital asset at a loss and repurchases a substantially identical one within a specific period. Currently, the IRS classifies digital assets as property, so existing wash – sale rules for traditional securities don’t apply. Detailed in our [Definition] analysis, this loophole allows some tax – deduction manipulation.

How to comply with potential future digital asset wash sale rules?

According to leading tax compliance tools, investors should stay informed about legal developments. First, keep detailed transaction records. Second, consult a tax professional knowledgeable about digital assets. Third, use reliable tax software to calculate obligations. This approach ensures compliance as the regulatory environment evolves.

Digital asset wash sale rules vs Tax – transparent fund jurisdictions: What’s the difference?

Unlike tax – transparent fund jurisdictions, which aim to provide efficient tax structures by passing liabilities to individual investors and avoiding double – taxation, digital asset wash sale rules are focused on preventing tax – deduction manipulation. Tax – transparent funds attract diverse investors, while wash – sale rules may limit certain trading strategies.

Steps for choosing a tax – transparent fund jurisdiction?

First, research jurisdictions with favorable tax laws and stable regulatory environments, like Luxembourg. Second, consider the type of fund and investment opportunities available. Third, use a fund jurisdiction calculator to assess which option suits your needs. This strategic approach helps maximize tax efficiency and investment returns.