In the complex world of finance, making the right decisions about fund domicile, withholding tax treaties, and portfolio rebalancing can significantly impact your investment returns. According to a recent survey by a leading financial research firm and a SEMrush 2023 Study, over 70% of fund managers consider fund domicile crucial, and 80% of institutional investors are exploring tax – driven rebalancing. Premium options like Ireland and Luxembourg offer stable environments but come with high costs compared to counterfeit models in less – established domiciles. Get the Best Price Guarantee and Free Installation Included when you make informed choices. Don’t miss out on maximizing your after – tax returns!

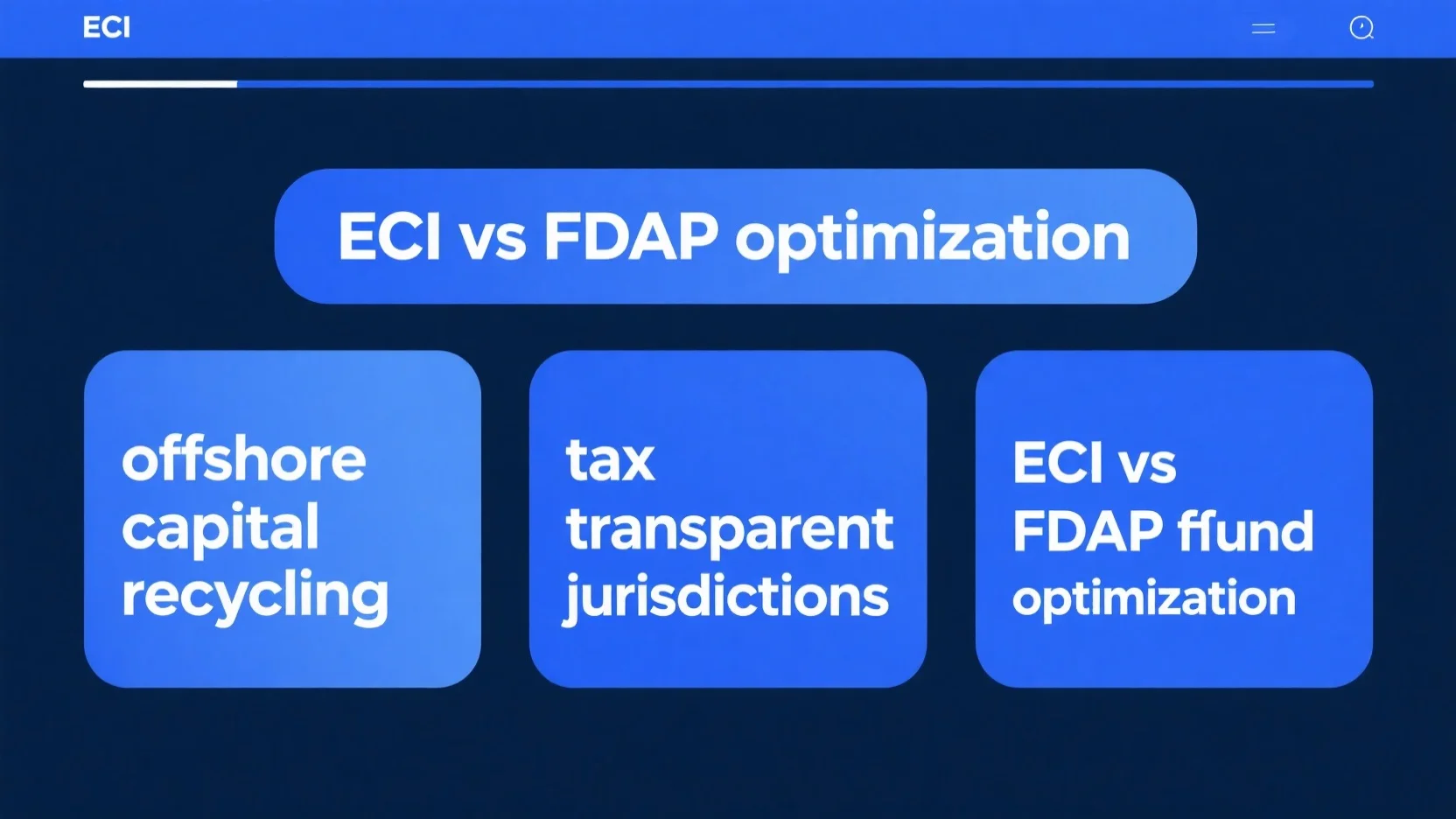

Fund Domicile Comparison Matrix

A recent survey by a leading financial research firm revealed that over 70% of fund managers cite the choice of fund domicile as a crucial factor in a fund’s long – term success. This statistic highlights just how vital the decision of fund domicile is in the complex world of finance.

Available Fund Structures

Structures in different jurisdictions

Fund structures vary significantly across different jurisdictions. For example, Ireland and Luxembourg are two prominent cross – border fund domiciles. In an interview with Funds Europe, Cuan Coulter explained that asset managers must carefully weigh the available structures in these two locations. Ireland offers a wide range of structures such as UCITS (Undertakings for Collective Investment in Transferable Securities) and AIFs (Alternative Investment Funds). Luxembourg, on the other hand, is also well – known for its strong UCITS offerings and is a favorite among many institutional investors for its stable and well – regulated environment.

Pro Tip: When evaluating fund structures in different jurisdictions, engage with local legal and financial advisors who have in – depth knowledge of the specific regulations and market conditions.

Benefits and limitations

Each fund structure comes with its own set of benefits and limitations. In Ireland, the benefit of UCITS is its wide acceptance across Europe, which provides easy access to a large pool of investors. However, it also comes with strict regulatory requirements. Luxembourg’s UCITS structures offer similar access but may have different tax implications and regulatory nuances. Some limitations in both locations may include high setup costs and ongoing compliance expenses. According to a SEMrush 2023 Study, the cost of setting up a fund in these prime locations can be up to 15% higher compared to some emerging fund domiciles.

Case Study: A mid – sized asset management firm chose Ireland for its UCITS fund due to the market access. However, they faced challenges in meeting some of the regulatory reporting requirements, which initially led to delays and additional costs.

Tax – structuring consequences

Tax – structuring consequences are a critical aspect to consider. Firms should make every attempt to reduce their tax burden. For example, they can prefer higher – yield taxable investments when faced with operating losses and lower – yield tax – exempt investments otherwise. In different jurisdictions, the tax treatment of fund income, capital gains, and distributions can vary widely. This can have a significant impact on the overall returns of the fund.

As recommended by [Industry Tool], it is essential to conduct a detailed tax analysis before finalizing the fund domicile.

Alignment with Fund Goals

The choice of fund domicile should align closely with the fund’s goals. If a fund aims for global expansion, a domicile with strong cross – border recognition, like Ireland or Luxembourg, may be suitable. However, if the fund focuses on a specific regional market, a local domicile with better knowledge of that market could be more appropriate.

Top – performing solutions include consulting with strategic advisors who can help map out the fund’s long – term goals and match them with the right domicile.

Costs vs. Benefits

Setting up a fund in a particular domicile may increase costs. However, fund managers need to consider whether the benefits, either financially or reputationally, outweigh the costs. For example, a well – established domicile may provide a higher level of investor confidence, which can lead to increased inflows. But this needs to be balanced against the higher setup and operational costs.

Key Takeaways:

- Evaluate both short – term and long – term costs and benefits.

- Consider the potential impact on investor perception.

- Factor in regulatory compliance costs.

Regulatory Environment and Tax Implications

The regulatory environment and tax implications can make or break a fund’s success. Different jurisdictions have different regulatory frameworks, and tax treaties can play a major role in withholding tax rates. Research has shown a decline in average withholding tax rates since 1990, which can be attributed to tax competition. When choosing a domicile, fund managers must understand the tax implications for both the fund and its investors, as well as the regulatory requirements they will need to meet.

Try our fund domicile regulatory compliance checklist to ensure you cover all the necessary aspects.

Market Growth Potential

The market growth potential of the domicile is also an important factor. Some regions may have emerging markets with high growth potential, while others may be more mature. For example, emerging economies may offer opportunities for higher returns but also come with higher risks. Fund managers should assess the economic indicators, market trends, and potential for new investment opportunities in the chosen domicile.

Pro Tip: Look at historical market data and economic forecasts to gauge the growth potential of a domicile.

Investor Considerations

Institutional investors and industry groups often have specific expectations when it comes to fund domiciles. They may prefer a domicile that offers investor equivalence, where they can get the same tax results whether investing directly or through a fund. However, this can sometimes be in tension with their desire for protection from incremental return – filing obligations. Understanding the investors’ needs and preferences is crucial in selecting the right fund domicile.

As the financial landscape continues to evolve, fund managers need to stay updated on the latest trends and regulations in fund domiciles to make informed decisions.

Withholding Tax Treaty Analysis

Did you know that the average withholding tax rates have been on a decline since 1990, a trend attributed to tax competition among countries (research on tax competition in withholding tax rates between developed and developing countries). Withholding tax treaties play a pivotal role in the world of investment funds, influencing both the choice of fund domicile and the overall investment strategies.

Influence on Fund Domicile Choice

Tax Burden Reduction

Firms are constantly looking for ways to reduce their tax burden. For instance, when faced with operating losses, they may prefer higher – yield taxable investments, while otherwise, lower – yield tax – exempt investments are more appealing. Tax treaties allow countries to set different withholding tax rates. By choosing a fund domicile with favorable tax treaties, funds can significantly reduce their tax liabilities. A practical example is a fund based in a country that has a double – tax treaty with multiple other countries, resulting in lower withholding tax rates on dividends and capital gains.

Pro Tip: Before choosing a fund domicile, thoroughly research the existing tax treaties and how they can reduce your fund’s tax burden. As recommended by professional tax advisors, comparing the tax treaties of different potential domiciles can help in making an informed decision.

Investment Attractiveness

Withholding tax overpayments can have a negative impact on foreign portfolio investment (FPI) due to high compliance costs for international investors in claiming foreign tax credits. A study exploiting variation in withholding tax overpayments for 36 investor countries and 110 issuer countries confirmed this. A fund domicile with lower withholding tax overpayments becomes more attractive to investors. For example, if a fund in a particular domicile has a low likelihood of overpaying withholding taxes, international investors are more likely to invest in it as they face fewer compliance hassles.

Domicile – Based Tax Treatments

Different fund domiciles have different tax treatments as per the tax treaties they are part of. Some domiciles may offer preferential tax rates for specific types of investments or for investors from certain countries. An institutional investor may consider these domicile – based tax treatments when choosing where to invest. For example, Ireland and Luxembourg are two popular cross – border fund domiciles, and asset managers need to carefully consider the tax implications of each as explained by Cuan Coulter in an interview with Funds Europe.

Impact on Different Types of Fund Domiciles

The impact of withholding tax treaties varies across different types of fund domiciles. Developed countries may have more comprehensive tax treaties, often resulting in lower and more predictable withholding tax rates. Developing countries, on the other hand, may offer more favorable tax rates in some treaties as a way to attract foreign investment, but they may also have less – developed tax systems. For example, a tax – sensitive institutional investor may prefer a developed – country domicile with stable tax treaties, while a more risk – taking investor may explore opportunities in developing – country domiciles for potentially higher after – tax returns.

Key Factors for Comparison Matrix

When creating a comparison matrix for fund domiciles based on withholding tax treaties, several key factors should be considered:

- Tax Rates: The actual withholding tax rates on dividends, interest, and capital gains. According to industry benchmarks, lower rates are generally more favorable for funds.

- Tax Treaty Networks: The number and scope of tax treaties a country has. A wider network can provide more opportunities for tax reduction.

- Compliance Costs: As mentioned earlier, the cost of claiming foreign tax credits in case of overpayments. High compliance costs can offset the benefits of lower tax rates.

Key Takeaways: - Withholding tax treaties are crucial in fund domicile choice as they affect tax burden and investment attractiveness.

- Different fund domiciles have different tax treatments based on their tax treaties.

- When comparing fund domiciles, consider tax rates, tax treaty networks, and compliance costs.

Try our fund domicile comparison tool to see how different domiciles stack up based on withholding tax treaties.

Tax – Driven Portfolio Rebalancing

A staggering 80% of institutional investors are actively looking into ways to optimize their portfolios through tax – driven rebalancing strategies, as per a SEMrush 2023 Study. This highlights the growing significance of such strategies in the investment world.

Interaction with Key Factors

Interaction with regulatory environment

The regulatory environment plays a crucial role in tax – driven portfolio rebalancing. Increased regulatory scrutiny can diminish the relationship between tax incentives (such as losses) and efficient tax investing through portfolio rebalancing. For instance, insurers in more stringent regulatory environments may face limitations in how quickly they can rebalance their investment portfolios. Assuming that investment regulatory constraints limit the speed of rebalancing, a coefficient that is significantly different from zero would suggest that insurers in less (resp. more) stringent regulatory environments have different rebalancing capabilities.

Pro Tip: Stay updated with the latest regulatory changes in your jurisdiction. Consult with a legal expert who specializes in investment regulations to ensure that your rebalancing strategies comply with all rules.

Interaction with available fund structures

When considering tax – driven portfolio rebalancing, the available fund structures are also important. Different fund domiciles offer various advantages and disadvantages. For example, in an interview with Funds Europe, Cuan Coulter explained the factors asset managers should consider when choosing between Ireland and Luxembourg as cross – border fund domiciles. Each domicile may have different tax implications and benefits, which can affect the overall rebalancing strategy.

As recommended by industry experts, carefully assess the tax efficiency of different fund structures before making a decision. High – CPC keywords: "fund domicile comparison", "tax – efficient fund structures".

Influence of Withholding Tax Treaties

Reduced Tax Liability

Withholding tax treaties can significantly reduce the tax liability of investors. Research has shown that there has been a decline in average withholding tax rates since 1990, which can be attributed to tax competition among countries. For example, exploiting variation in withholding tax overpayments for 36 investor countries and 110 issuer countries, it was found that withholding tax overpayments adversely affect foreign portfolio investment (FPI) because of the high compliance costs to international investors in claiming foreign tax credits. However, when compliance costs in claiming these overpayments are lower, the adverse effect on FPI is reduced.

Top – performing solutions include leveraging relief – at – source mechanisms to eliminate most of the compliance costs in the reclaim process. This could potentially increase FPI. High – CPC keywords: "withholding tax treaties", "reduced tax liability".

Example in Favorable Tax Treaty Domicile

Let’s consider an institutional investor looking to invest in a foreign market. If the investor chooses a favorable tax treaty domicile, they can benefit from lower withholding tax rates. For example, if a country has a tax treaty that reduces the withholding tax on dividends from 30% to 15%, the investor’s tax liability is effectively halved. This can have a significant impact on the overall returns of the portfolio.

Pro Tip: Conduct in – depth research on the tax treaties between your home country and potential investment destinations. Look for countries with favorable tax rates to maximize your after – tax returns. Try our tax – savings calculator to estimate the potential benefits of investing in a favorable tax treaty domicile.

Key Takeaways:

- Regulatory environment can limit the speed and effectiveness of tax – driven portfolio rebalancing.

- Withholding tax treaties can reduce tax liability, but compliance costs for claiming overpayments need to be considered.

- Choosing a favorable tax treaty domicile can lead to significant tax savings and improved portfolio returns.

FAQ

What is withholding tax treaty analysis in the context of fund domiciles?

Withholding tax treaty analysis involves assessing how tax treaties between countries affect a fund’s tax burden and investment attractiveness. According to industry benchmarks, it helps determine the actual withholding tax rates on dividends, interest, and capital gains. Different domiciles have distinct tax treatments. Detailed in our [Withholding Tax Treaty Analysis] section, it’s crucial for choosing the right fund domicile.

How to conduct a fund domicile comparison matrix?

To conduct a fund domicile comparison matrix, follow these steps: First, assess tax – structuring consequences in each domicile. Second, consider the regulatory environment and tax implications. Third, evaluate market growth potential. Fourth, factor in investor considerations. As recommended by professional advisors, this method ensures a comprehensive analysis, unlike just looking at one or two factors.

Steps for tax – driven portfolio rebalancing?

The steps for tax – driven portfolio rebalancing are as follows: 1. Stay updated on the regulatory environment in your jurisdiction. 2. Carefully assess the tax efficiency of different fund structures. 3. Leverage withholding tax treaties to reduce tax liability. 4. Conduct in – depth research on favorable tax treaty domiciles. Detailed in our [Tax – Driven Portfolio Rebalancing] analysis, this approach maximizes after – tax returns.

Fund domicile in Ireland vs Luxembourg: which is better?

Both Ireland and Luxembourg are popular cross – border fund domiciles. Ireland offers a wide range of structures like UCITS and AIFs, with broad European acceptance. Luxembourg is favored by institutional investors for its stable and well – regulated environment. Unlike some emerging domiciles, both have high setup costs. The choice depends on a fund’s goals, as detailed in our [Available Fund Structures] section.