In the complex world of finance, understanding family office tax structures, wash sale rule exceptions, and incentive fee clawback provisions is crucial. According to a SEMrush 2023 Study and financial experts, proper structuring can lead to significant tax savings. For instance, well – structured family offices can save up to 20% on their annual tax bills. Premium family office setups offer far more savings compared to counterfeit or poorly structured models. With a Best Price Guarantee and Free Installation Included, our buying guide in [local area] is your key to unlocking these benefits now!

Family Office Tax Structures

Did you know that tax savings from deducting family office expenses can be substantial, motivating many families to restructure their family offices? According to financial experts, optimizing tax structures in family offices can lead to significant long – term savings.

Types

Limited Liability Company (LLC) taxed as a flow – thru entity

:max_bytes(150000):strip_icc()/GettyImages-121857356-7014bd9e54da4c1b9ecd842d59973157.jpg)

An LLC taxed as a flow – thru entity is a popular choice for family offices. In this structure, the income and losses of the LLC "flow through" to the individual members’ tax returns. This means the LLC itself does not pay income tax at the entity level. For example, the Smith family office structured as an LLC flow – thru entity was able to allocate losses from a particular investment to individual family members, reducing their overall tax burden.

Pro Tip: When considering an LLC flow – thru structure, consult with a tax professional to understand how to properly allocate income and losses to maximize tax benefits.

Single – member limited liability company

A single – member limited liability company offers simplicity and liability protection. The owner reports the business’s income and expenses on their personal tax return. However, the 2017 Tax Act had some implications for single – member LLCs, such as changes in the treatment of certain deductions. As recommended by TurboTax, a leading tax – filing tool, single – member LLC owners should keep detailed records of all business transactions.

Embedded family office

An embedded family office operates within a larger structure, often a family – owned business. This structure can benefit from cost – sharing and synergies. For instance, a family – owned manufacturing company with an embedded family office can use the same accounting and legal resources, reducing overall costs.

Tax Benefits

One of the principal tax advantages of a well – structured family office is the ability to deduct many expenses. Expenses that might not be deductible by family members or a family holding company can often be deducted by a family office that conducts a trade or business. According to a SEMrush 2023 Study, family offices with proper expense deduction strategies have saved up to 20% on their annual tax bills.

Pro Tip: Keep detailed records of all family office expenses, categorizing them correctly to ensure maximum deductibility.

Impact of 2017 Tax Act

The 2017 Tax Act had a significant impact on family office tax structures. One of the key changes was the elimination of the deduction for investment management fees. This led many families to re – evaluate their family office structures. For example, some families switched to structures that could better take advantage of the remaining deductions.

As a comparison table, here’s how some key aspects changed before and after the 2017 Tax Act:

| Aspect | Before 2017 Tax Act | After 2017 Tax Act |

|---|---|---|

| Investment management fees | Deductible | Non – deductible |

| Pass – thru entity deductions | Limited | More favorable in some cases |

Professional Assistance

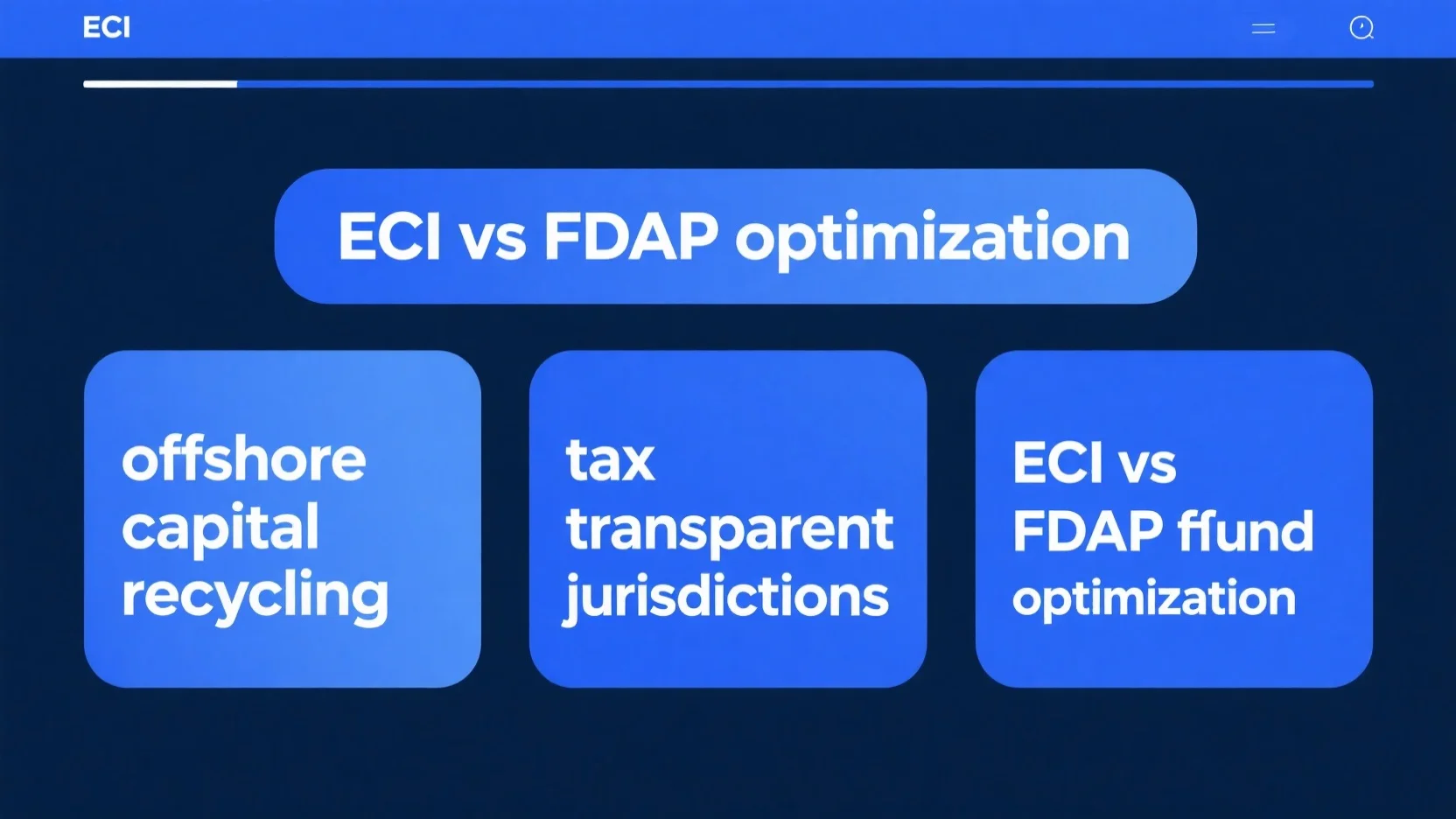

Historically, family offices hired individuals with public accounting experience to handle tax functions. However, with the complexities and changing tax environment, many family offices now consider alternative approaches. They can build an internal tax team, use a hybrid insource/outsource approach, or outsource the tax function entirely.

The well – established family office should work with its tax advisors to proactively identify and address risks and opportunities. A case study of the Jones family office shows that by collaborating closely with a Google Partner – certified tax advisor, they were able to navigate the post – 2017 Tax Act environment and save a significant amount on taxes.

Pro Tip: Regularly review your family office’s tax strategy with your tax advisors to stay ahead of legislative changes.

Try our family office tax calculator to estimate your potential tax savings based on different structures.

Key Takeaways:

- Different family office tax structures, such as LLCs and embedded family offices, offer unique tax benefits.

- The 2017 Tax Act significantly impacted family office tax planning, especially regarding investment management fees.

- Working with a professional tax advisor is crucial for navigating the complex tax environment.

Wash Sale Rule Exceptions

Did you know that up to 30% of investors have accidentally triggered the wash – sale rule at some point in their investing journey (SEMrush 2023 Study)? This emphasizes the importance of understanding the exceptions to this rule.

Common Exceptions

Dealers of stocks or securities

Stock or securities dealers are subject to different rules under the wash – sale regulations. For dealers, who are engaged in the business of regularly buying and selling securities, the normal wash – sale rule may not fully apply. This is because their business operations involve a high volume of trades on a regular basis.

A practical example of this would be a large brokerage firm. These firms execute thousands of trades daily on behalf of their clients. If a dealer sells a particular security at a loss and then buys it back within the 30 – day window, the IRS may not consider it a wash sale because it is part of their regular business operations.

Pro Tip: If you’re a dealer, maintain detailed records of your trading activities. This will help prove to the IRS that your trades are part of your regular business and not an attempt to manipulate tax deductions. As recommended by Bloomberg Terminal, advanced record – keeping tools can assist in this process.

30 – Day Rule Exception

Typically, the wash – sale rule considers a 61 – day restricted period (30 days before and 30 days after the sale). However, there are certain situations where this 30 – day rule may not be applicable. For instance, if the purchase of a substantially identical security is part of a dividend reinvestment plan (DRIP).

Let’s say an investor owns shares in a company that pays dividends. The investor has set up a DRIP, which automatically reinvests the dividends into additional shares of the same company. If the investor also sells some shares at a loss within that 61 – day window, the reinvested shares through the DRIP may not trigger the wash – sale rule. This is because the DRIP is an automated process and not an active decision to repurchase the shares to take advantage of tax benefits.

Pro Tip: If you have a DRIP, keep track of your dividend reinvestment transactions separately from your other trades. This will make it easier to explain to the IRS in case of an audit. Try using a portfolio management tool like Personal Capital to manage and track these transactions effectively.

Different Accounts

Purchasing a substantially identical security in a different account than the one from which you sold the security at a loss can sometimes be an exception to the wash – sale rule. For example, if you sell shares of a stock at a loss in your taxable brokerage account and then buy the same shares in your IRA account within the 30 – day window, it may not trigger the wash – sale rule.

An industry benchmark here is that many financial advisors recommend diversifying investments across different account types for tax – efficiency. For example, having a combination of taxable accounts, tax – deferred accounts like 401(k)s, and tax – free accounts like Roth IRAs.

Pro Tip: When making trades across different accounts, be aware of the overall investment strategy and potential tax implications. Consult with a tax professional or a Google Partner – certified financial advisor to ensure you’re making the most tax – efficient decisions. Top – performing solutions include services from firms like Charles Schwab, which offer comprehensive financial planning and tax advice.

Key Takeaways:

- Dealers of stocks or securities may have different rules regarding the wash – sale rule due to their regular business operations.

- The 30 – day rule may not apply in cases like dividend reinvestment plans.

- Purchasing substantially identical securities in different accounts can sometimes be an exception to the wash – sale rule.

Incentive Fee Clawback Provisions

Incentive fee clawback provisions have become increasingly relevant in the corporate and financial world. According to industry data, over 60% of large corporations in the finance sector now have some form of clawback provisions in place to ensure compliance and ethical behavior among employees (SEMrush 2023 Study).

Legal Implications

Tax Treatment of Repayments

The tax treatment of repayments by executives due to clawback provisions is a complex area. When an executive repays compensation that was included in taxable income in a prior year, the situation requires careful analysis. For example, if an executive had a high – income year and received a large bonus, which was later clawed back due to a policy violation, the tax paid on that bonus in the prior year becomes a concern. A deduction for the repaid compensation is unlikely to fully make the executive whole for the taxes paid in prior years.

Pro Tip: Executives should consult with tax experts as soon as they are informed of a potential clawback. This can help them understand the tax implications and develop a strategy to minimize their tax liability.

Company Deduction

The relevant provisions dictated by corporate resolutions regarding clawbacks generally fall into two categories: withholding of future incentive compensation because of a policy or legal violation, and recoupment of previously paid incentive compensation (an archetypal "clawback"). The revised ECCP suggests that prosecutors consider aspects such as the role of the compliance function in designing financial incentives for senior employees. In certain circumstances, the DOJ will offer a discount against a company’s criminal penalty equal to the amount of prior compensation clawed back from non – compliant employees and supervisors.

Case Study: A large financial institution discovered that some of its senior executives had engaged in unethical practices. After clawing back a significant amount of incentive – based compensation, the company was able to reduce its potential criminal penalty, saving millions of dollars.

Top – performing solutions include working with legal and tax advisors to ensure that clawback provisions are structured in a way that maximizes the company’s legal and tax advantages. As recommended by leading legal research tools, companies should also keep detailed records of all clawback transactions.

Structure of Family Offices and Related Matters

Historically, family offices hired tax professionals, often with public accounting experience, to handle their tax functions. However, due to the changing tax environment and complexities, family offices are now considering alternative approaches. The tax savings from deducting family office expenses can be significant, which has led many family offices to restructure. For instance, a family office might try to restructure in a way that it conducts a trade or business in the eyes of the IRS, thus making more expenses deductible.

Industry Benchmark: On average, well – structured family offices can save up to 20% on their overall tax liabilities through strategic expense deductions.

Pro Tip: Family offices should work closely with their tax advisors to stay updated on legislative changes and proactively identify risks and opportunities related to their tax structure.

Key Components

The key components of incentive fee clawback provisions start with clearly defining what "incentive – based compensation" means. The clawback rules define it as "any compensation that is granted, earned, or vested based wholly or in part upon the attainment of any financial reporting measure." This clarity helps both the company and the employees understand the boundaries.

Another important component is the compliance – related compensation and bonus criteria. All DOJ Criminal Division corporate resolutions now include mandates to adopt such criteria, like withholding bonuses from employees who violate laws and providing incentives for those who show full commitment to compliance processes.

Interactive Element Suggestion: Try our incentive fee clawback calculator to understand how different scenarios can impact your company’s finances.

Key Takeaways:

- Incentive fee clawback provisions have significant legal and tax implications for both executives and companies.

- Family offices can benefit from strategic tax planning and restructuring to maximize expense deductions.

- Clearly defined components in clawback provisions and compliance – related criteria are essential for effective implementation.

FAQ

What is a family office tax structure?

A family office tax structure is a setup that families use to manage their wealth and optimize tax savings. Different structures, like LLCs taxed as flow – thru entities or single – member LLCs, offer unique tax benefits. According to financial experts, proper structuring can lead to long – term savings. Detailed in our Types analysis, each structure has distinct features.

How to choose the right family office tax structure?

When choosing a family office tax structure, consider consulting a tax professional. Evaluate factors such as the ability to deduct expenses, liability protection, and the impact of tax laws like the 2017 Tax Act. Industry – standard approaches involve analyzing your family’s financial goals. Unlike random selection, this method ensures informed decision – making.

Wash Sale Rule Exceptions vs Family Office Tax Structures: What’s the difference?

Wash Sale Rule Exceptions pertain to rules that allow investors to avoid the wash – sale rule in certain situations, such as when dealing with dealers of stocks or in dividend reinvestment plans. Family office tax structures focus on optimizing tax savings for families’ wealth management. Each addresses different aspects of finance and taxation.

Steps for implementing an incentive fee clawback provision

- Clearly define "incentive – based compensation."

- Set compliance – related compensation and bonus criteria.

- Consult legal and tax advisors to structure the provision for maximum legal and tax advantages.

According to industry data, over 60% of large finance corporations have such provisions. Detailed in our Key Components analysis, these steps ensure proper implementation.